On this episode of Motley Fool Money, host Chris Hill together with Motley Fool analysts Jason Moser, Andy Cross, and Ron Gross hit on this week's biggest stories in the market. NVIDIA (NASDAQ:NVDA) shares popped 10%, but shareholders should temper some of their excitement. Coca-Cola (NYSE:KO) and Pepsi (NASDAQ:PEP) both reported, and the market really seems to prefer the blue team this time around. Under Armour (NYSE:UA) (NYSE:UAA) is getting its act together but still has some big challenges ahead. Activision Blizzard (NASDAQ:ATVI) remains crushed amid competition and layoff concerns. And, as always, the guys share some stocks on their radar this week. Also, Chris Hill talks with corporate governance expert and movie critic Nell Minow about Capitol Hill's new interest in buybacks, Facebook's (NASDAQ:FB) big governance problems, and some predictions for the Academy Awards.

A full transcript follows the video.

This video was recorded on Feb. 15, 2019.

Chris Hill: It's the Motley Fool Money radio show! I'm Chris Hill. Joining me in studio this week, senior analysts Jason Moser, Andy Cross, and Ron Gross. Good to see you as always, gentlemen! We've got the latest headlines from Wall Street. We'll talk stock buybacks and get an Oscars preview from our guest Nell Minow. And, as always, we'll give you an inside look at the stocks on our radar.

Guys, just when you thought the Amazon (NASDAQ:AMZN) HQ2 nightmare was over! This week, Amazon announced it is dropping the deal to build a second headquarters in New York City due to rising political protests. The one here in Northern Virginia is still on. That means, among other things, Jason, that the second headquarter location close to Ron Gross' house is still very much --

Ron Gross: [laughs] Back on the table?

Andy Cross: And mine!

Jason Moser: It's still on the table. It always struck me as odd that they chose New York to begin with. It just didn't seem like it was really in the center of the conversation. But they went with it, and now they're not going with. It seems like a lot of political back-and-forth. I don't know that I necessarily have an opinion on that. It does seem to me, the political concerns are perhaps a little bit more short-sighted. It seems like in the press that the story is being communicated that Amazon was going to get all of these incentives. It's important to remember, these incentives were based on conditions. There were conditions where they had to meet certain numbers regarding hiring, and then they would receive these incentives. It wasn't like New York was just giving up all of this stuff. There was a performance bonus involved with all of this.

With that said, it does sound like it went down to the final hour and they couldn't make it work, so you just move forward. It ought to bring a few more jobs here to Virginia, I would imagine.

Hill: Like you, I was a little surprised when they split it between northern Virginia and New York City. But Andy, you were saying before we started taping, you weren't surprised?

Cross: Yeah. Actually, according to the Brookings Institution, New York has one of the largest tech forces in America, followed by Washington, D.C. Those two big markets have lots of tech people that Amazon could hire. To me, for this one, it seemed like Amazon was pushing what they wanted, and they got a little pushback and they didn't like it, so they said, "Hey, we're taking our jobs elsewhere."

Gross: Which is their prerogative. I don't think this hurts Amazon in any way. I hope it doesn't hurt those communities that are going to not have the capital investment that Amazon was going to bring. But I don't think Amazon misses a beat.

Moser: Yeah, I think you're right. This doesn't hurt Amazon. New York needs Amazon more than the other way around. It was really interesting to read the stories about all the real estate speculation that began as soon as this decision was made. Judging from what I was reading, real estate agents were taking requests, purchases were being made sight unseen via text message and whatnot. And lo and behold, now it seems like they're not necessarily going to have that same business landscape that they thought they might have. I'm sure there probably are some real estate investors/ speculators that are feeling a little bit of the pinch right now.

Hill: Well, fingers crossed that they pull the trigger quick. I'd really hate to think that in six months, we're still talking about taking this story.

Gross: Yeah, I'm fatiguing on the whole thing.

Hill: [laughs] Alright, let's get to the week's earnings news. Shares of NVIDIA up nearly 10% this week. Fourth quarter profits came in higher for the chip maker. Andy, it's been a rough 12 months for shareholders. I'm wondering, is this a representation that NVIDIA turned things around? Or was this a stop-the-bleeding situation?

Cross: I think it's the latter, Chris, it's stop-the-bleeding. I think investors looked at this and said, "OK." They're talking about how the inventory hangover from the crypto boom, which drove a lot of their gaming sales revenues and growth over the last couple of years, which caused problems when that market suffered last quarter, and the stock fell from $280 down to $130 over the course of a couple of months. They said that will play out mostly through this first quarter. While the growth picture for NVIDIA will probably basically be about flat this year, investors are saying, at least that crypto boom hangover has now passed. We still have the China concerns, but that's a good sign for NVIDIA and for the shareholders as well.

Hill: In terms of NVIDIA's management, safe to assume you like this strategy of downplaying expectations for 2019?

Cross: I do, yes. They're still the leader in these high-end graphics cards. AMD and Intel are coming after them and very competitive. NVIDIA has this lead. Jensen Huang, who owns 3% of the company, more than the $3 billion, the CEO and the founder of the business, continues to innovate. They have some pricing power, although they started saying, "Listen, we're going after the mid-tier pricing." I still think they're downplaying a little bit of the potential across all of their units. Gaming was down but data center was up, visualization was up, automated was up. Their other lines of business continue to drive the growth in NVIDIA. If they can get through the gaming side on the crypto craze from last quarter, that's a good sign for NVIDIA.

Hill: Coca-Cola and Pepsi both out with fourth-quarter reports this week. Both dealing with foreign-currency headwinds, but investors seem more confident in Pepsi's business, Ron. On Thursday, shares of Coca-Cola had their worst day in over a decade.

Gross: Oof. Neither company is knocking it off the ball over the last year, but I think Pepsi, at least the perception is that they've reacted to changing consumer preferences a bit better. Partly through acquisitions like SodaStream and Bare Foods.

While they both lowered guidance, Coke's was more serious. It was based on lower revenue growth, slowdown in emerging markets. Pepsi's were more like currency headwinds, tax rates, making investments to actually grow the business. So I think investors gave Pepsi a pass while Coke got slammed.

Hill: When you think about acquisitions, Pepsi has the Frito-Lay business. They can make acquisitions in the salty-snack industry in a way that Coca-Cola probably is never going to.

Gross: It's not there. They're willing to spend the money, as they have recently with Bare Foods, to go with those changing consumer preferences. People don't like sugar anymore, it turns out, and --

Hill: Whoa, whoa, hold on!

Moser: Hold on a second, now!

Hill: Some of us still like sugar!

Gross: Perhaps some people no longer like sugar as much as they once did. Pepsi is reacting to it. Now, Coke is, too, let's not forget. Coke is actually going to be introducing the Orange Vanilla Coke in the near future. I'm not sure I like the sound of that. I think people like the taste of orange vanilla together. Is that a Creamsicle? Yeah, that's a Creamsicle, maybe that works. But, as we go toward healthier items, I'm not sure that's the way to go.

Cross: Orange Julius, baby!

Moser: As I was sitting there enjoying my Quaker oatmeal this morning and watching Pepsi's stock go up a little bit based on this call, I decided to go ahead and at least look through the call and see if we could get a little bit more information as to what they're going to be doing with SodaStream. I'm still a little bit baffled by that one. Unfortunately, there is no real information. They just basically acknowledged that the acquisition was made in the call. Didn't talk anything about any strategy whatsoever. Maybe that's just new leadership trying to get a grip on the fact that they own this thing now. I'm not sure that Indra Nooyi necessarily had a plan for it, either. But to me, that's going to be the big question of 2019. What are they going to do with that business?

Gross: But, Jason, you can make seltzer in your home!

Moser: [laughs] I understand that, Ron. I still won't do it.

Gross: [laughs] You need more of a strategy than that?

Moser: Hey, I'm a seltzer guy, but I'd rather buy the 12-packs at the store.

Gross: By the way, neither of these stocks are expensive. 19X, 20X, depending what the guidance looks like going forward for both. While Pepsi is outperforming from an operating perspective right now, both could be a decent play.

Hill: One more thing on the acquisition front. We talk about Pepsi and their acquisitions. It was last summer that Coca-Cola bought Costa Coffee for around $5 billion. That's the U.K.-based coffee brand. It seems like they need to make that work sooner rather than later.

Gross: For sure. As we know, many acquisitions actually don't go the way they're supposed to. This is an important one. They took a stake in the energy drink Bodyarmor, which they want to make work. They're thinking about maybe releasing their own energy drink.

Hill: To compete with the one that they bought?

Gross: They've got plenty of them. Maybe they should release a flavored seltzer drink. I don't think we have enough of those in the marketplace right now.

Hill: Shares of Under Armour up a bit this week after fourth-quarter profits and revenue came in higher than expected. Jason, if you're looking for bright spots -- and as a shareholder, I am -- it does look like Under Armour is doing a better job of managing their inventory.

Moser: I agree with that. Going into this quarter, the biggest question for me was revolved around North America. North America has been a real weak point for the business here over the past number of quarters. That doesn't really seem to offer all that much encouragement. To put it into context, Under Armour reported North American sales down 6%. Their competitor, Nike, just reported sales up 9%. We're seeing the tale of two different athletic companies here. Nike's stock has responded accordingly.

With that said, it was ultimately a mixed-bag quarter for Under Armour. There were some things to like about it. We know they do have a very strong international business. Those sales were up 35% ex currency. Gross margin actually up 160 basis points based on not only a little bit of pricing power there, but also wringing out some efficiencies in the business. To your point, they're getting inventory levels back in check very quickly. I attribute that to Kevin Plank taking this seriously, bringing on a CFO and COO who can help him guide this business, take it to the next level. They also hired a chief culture officer, Tchernavia Rocker, who has 22 years of experience at Harley-Davidson. Encouraged, having her on the team. They're building a long-term sustainable place where people want to be. That's been one of the big red flags with Under Armour for a while, is can Kevin Plank assemble a team of people that want to stay there and work for him? It seems like maybe now he's starting to figure out how to do that.

Hill: We talk about pricing power from time to time. It's interesting to think back a few years when Lululemon was starting to rise, had good success selling the high-end yoga pants. One of the things we talked about on this show was, once a Nike and Under Armour get in there at a lower price point, that could spell doom for Lululemon. You look at just Lululemon and their strategy of not really discounting, being more of a premium brand, that appears to have paid off in ways that Under Armour's discounting strategy and being in outlet malls all over the country really hasn't.

Moser: Yeah, there's no question that Under Armour could one day become like Nike in that regard, everybody wearing Under Armour clothing whether it's for casual nature or athletic nature. But really, Under Armour was founded based on that performance equipment. It was the compressed and the wicking shirts and all that. So for them to make that move into being more things for more people is a bit of a trick. They seem to have gotten away from their real specialty to begin with. Again, if they can get back to managing that business, focus on running a tight ship. Growth will come if you make good decisions. But don't make decisions based on just wanting to grow the company. That's what they've been doing these past several years.

Cross: One thing Lululemon has done so well, Chris, since you mentioned it, they've enhanced and built that community in the local areas where they have their stores around yoga and events. That's been very valuable for them, to be able to enhance their brand. Like Jason was saying, the focus for Under Armour is in this area. The focus for Lululemon has been in that area, and it's done really well for them. The stock's done very well, at least relative to Under Armour, in the past couple of years.

Gross: It's interesting from an investor perspective. It's very, very difficult to predict a company like Lululemon's success down the road. There's fashion involved, there's consumer preferences, there's changing wants and desires from consumers. Whereas a company like Nike is a little bit easier to predict the future on because of their bread-and-butter business. That's why I think fashion retail, specialty retail, if you can predict a year or two out in these things, more power to you.

Cross: The golf business for Nike had its ups and downs. It was flying high at one point during the heyday of Tiger Woods, and then it totally collapsed.

Moser: If you rewind 20, 25 years ago, even further, 30 years ago, we look at Nike back then. It was obviously a much smaller operation. Would not have been easy to predict the success they've come to know today. That's all just to say that with Under Armour, I know that Kevin Plank, his goal is to supplant Nike and become the No. 1 brand. But you have to remember, one of the biggest variables in that equation is time. It's going to take a while to get there. You can't discount the fact that Nike's been at it for a long time. Under Armour will be, too.

Hill: Shopify's (NYSE:SHOP) fourth-quarter loss was smaller than expected. I guess that's something, huh, Andy?

Cross: I guess it is. Stock investors in Shopify aren't quite caring so much about the profit picture right now. It's really about the growth. Their sales were up 43% for the subscription solutions. The merchandise volume, which is all the volume across Shopify's platforms that are sold, was up 54% in the quarter. Monthly recurring revenue up 37%. Those are all a little bit lower than last year's quarter. The growth is definitely slowing. But for a $20 billion company, that's to be expected. The operating profit margin expanded a little bit on an adjusted basis. Same with the income per share.

Just look at the Cyber Monday and the Black Friday sales last year. They did $1 billion across those periods of all the merchandise volume for Shopify. This year, it was $1.5 billion. More traffic going through Shopify's platform.

Hill: Is this a business that eventually, when they get to the point of profitability, it's reasonable to expect they stay that way? Certainly in Amazon's past, they had a profitable quarter here, and then it was right back to being losses quarter after quarter.

Cross: That's because of the investments that Amazon's making. Shopify certainly is. I think what investors are seeing is, the growth is still there on the sales line. They're starting to see that profit curve start to show up. When that all starts to take off in the next couple of years, the profit picture should be much healthier, and I imagine much more consistent.

Hill: Shares of Activision Blizzard still hovering around a two-year low this week. Fourth quarter results were not great and guidance for the first half of 2019 was weak. Ron, they've got some great game franchises, but they have got real problems.

Gross: I know my colleague last week, Aaron Bush, had a very forceful opinion about this. But just because it was forceful doesn't make it right. Love you, Aaron! It's really about the changing video game model here. Fortnite is the face of that changing model, but it's not the only game in town there. It's about the free battle royale game and the switch to those kinds of gaming experiences. Activision does not have a strong presence there. They're going to lay off 8% of the workforce. Interestingly, they're going to boost the number of developers by 20% and put them into some of their biggest games like Call of Duty, World of Warcraft, Diablo, but not necessarily move into this battle royale space to go head-to-head against Epic Games and Fortnite and the new Apex Legends, which is taking the world by storm. Activision doesn't necessarily plan to do that.

Cross: Speaking of Fortnite, they launched their merchants tour on Shopify's e-commerce platform last quarter.

Hill: Restaurant Brands International (NYSE:QSR) is the parent company of Burger King, Popeyes, and Tim Hortons. Fourth quarter results looked good at well, two out of three, Jason.

Moser: Getting hungry just from that read-in, Chris. I look at these types of businesses, these big restaurant companies, and I think a lot of them are pretty decent income plays if you can find well-run operations. Restaurant Brands is one of them. It has some compelling brands there. Perhaps maybe second-tier brands, we would consider here, with Burger King and Tim Hortons and Popeyes. But, the numbers are the numbers. Systemwide sales growth was 6.8% for the quarter with Burger King showing the way. Good, healthy mix of store growth and actual sales numbers. Positive comps for all three. Popeyes was closer to flat.

I think when you look at this company big picture, it's around 25,000 restaurants today worldwide. You compare that with something like McDonald's (NYSE:MCD), where they're somewhere in the neighborhood of 37,000, there's clearly the opportunity to grow the footprint there. I'm going to say the C-word here -- China's the wild card. They just signed a master franchise joint venture that's going to result, hopefully, in 1,500 new restaurants over the next decade. That's important to note, the next decade. That doesn't seem like they're going to go in there guns ablazin' and just open 500 stores a year. But there's a big opportunity there.

Hill: You're saying an American business thinks that there's a growth opportunity in China?

Moser: I'm just putting it on the table for listeners! We just put it out there, they get to decide. But I think at the end of the day, Restaurant Brands company pays a 3.1% dividend yield that should continue to grow over time. The nice thing about these restaurants, people have to eat, and most people are out there looking for some kind of a compelling value. They're covering the gamut, right? From Burger King to Tim Hortons to Popeyes. We can't discount the fact that they may roll another concept in there at some point, too.

__

Hill: Later this month, there will be drama at the Academy Awards. But there's already drama in America's corporate boardrooms. So of course, we turn to the only guest who can discuss both. Now Minow is the vice chair of ValueEdge Advisors. She is also the film critic known as the Movie Mom. She joins me now. Nell, good to talk to you!

Nell Minow: Thank you! Glad to be back!

Hill: Before we get to the movies, let's start with the topic of stock buybacks. This is something that comes up on a pretty regular basis on this show, usually in the form of us discussing Company X announcing a billion-dollar buyback plan. It's now gotten the attention of the folks on Capitol Hill. Senators from both sides of the political aisle are coming forward with their plans to limit companies' ability to buy back stock. This is something you just wrote an op-ed on. How big a problem is this and what do you think the solution is?

Minow: I think it's a big problem, and I can tell you the solution is not what senators Schumer and Sanders are proposing, which is Looney Tunes. They want to prohibit buybacks at companies that are not paying $15 an hour minimum wage. This is crazy because, of course, that's very skewed according to the sector and has nothing to do with anything.

The reason that buybacks are a problem is, it's sometimes the case when a very useful financial instrument gets completely distorted and out of hand and starts to cannibalize the financial system. We saw something like that back in 2008. In this case, we have the tax cut bill, which everybody promised us was going to go to strategic investment and R&D and doing better at compensating employees. And, of course, it went straight to buybacks, with last year having a record trillion-dollar buyback number. Most of that was in maybe 20 companies, but still.

It seems to me that the very last thing that I want a board of directors to do with excess cash is to overpay for an acquisition, which of course happens quite often. But my second least favorite thing for them to do -- getting a D rather than an F -- is a buyback. That's basically their way of saying, "We're out of ideas. We have nothing. We have nothing here. We have no ideas of how to improve our products or improve our operations or improve our marketing or do better by our employees. We're just going to give you back the money that you've invested."

My particular problem with buybacks is that companies never adjust their EPS targets. So, really, the insiders are getting a triple-dip. First, of course, they get the increase in the stock price, and they're all large stockholders. Second, very often -- and this has been documented by SEC Commissioner Jackson -- they sell into the buybacks. So, while they're telling the market the stock is undervalued, so it's a great thing to do to buy back stock, they're selling into it, which is certainly at the very least a mixed message. The third thing is, there are two ways of meeting an EPS target: You can increase your earnings or you can reduce the number of outstanding shares. Companies don't reflect that when they do a buyback. They get an extra windfall in their incentive compensation because they've met their EPS goals.

Hill: How much of this could be helped by simply providing more transparency? Again, a lot of companies just come out with their quarterly earnings report and say, "Oh, by the way, we've allocated a couple of billion dollars for a buyback plan over X amount of time." It seems like if they went a couple of steps further in terms of saying, "Oh, by the way, here's how we're going to be evaluating opportunistic buying," because for a long time, Warren Buffett was very clear in terms of essentially setting a book value target for when he would buy back shares of Berkshire Hathaway.

Minow: Exactly. In the piece that you mentioned, I talk about a study that really shifted my timbers, and really is part of what got me interested in buybacks in the first place. The study was a couple of years ago, where they interviewed directors and said, "Explain to me what exactly your calculus was for deciding that a buyback was an appropriate thing to do right now." They all said, "Huh?" They really had nothing. And in terms of their disclosure, as you said, they almost never give any specifics about why they think it's the best possible use for their corporate assets. So, yeah, that would be important.

I'm proposing in my piece two absolute requirements. I would not allow a buybacks unless the companies did two things. One is, as I said, adjusting the EPS target so that you're not getting any double dealing there. The other is, I would not let the insiders sell into the buyback. In fact, I'm very hard line about it, I would not allow them to sell any of their shares or their exercise option shares for up to three years following the buyback just to make sure that their decision about buying back stock is made for the long-term benefit of the shareholders.

Hill: It's not often that the world of corporate governance involves a high level of mystery, intrigue, and blackmail. That's at the heart of Jeff Bezos' allegations against the National Enquirer. If you are a member of Amazon's board of directors, what would you be thinking about these recent developments? What would you be saying when it got to be your turn to speak in the boardroom?

Minow: I would stand up and cheer. I think it's absolutely terrific, what he did was wonderful. It has no effect whatsoever on his ability to lead the company. Pretty much everything was already out. He and his wife had already separated. It was already public knowledge that he had a girlfriend. This other stuff is just trivial. There was nothing abusive about it, there was nothing furtive about it. So, I think it's absolutely fine. Good for him. In the past, when we've seen CEOs get into trouble over extramarital relationships or any kind of relationship, it's been a problem when, for example, they paid them in some way, they brought them on as consultants, or there was some kind of an abusive structure, where he was the supervisor -- I'm going to say "he" because it usually is a he -- something like that. But in this case, what he did in his own time was fine, and he handled it, I thought, in an exemplary fashion.

Hill: You were recently quoted as saying that Facebook needs independent directors. What do you see as the primary problem at Facebook that independent directors helps fix?

Minow: Let's just talk about this first -- is it possible for Facebook to have independent directors as long as the CEO and founder has the controlling amount of the stock? I think it is. It's a little tricky to make that work, but it can happen, and I'll tell you how it can happen.

But the reason I think it's so important is, the single stupidest thing that anybody can do, whether it's an individual or a company, is to enter into some consent agreement with the government and then violate it. That's a slam dunk. Not just for the government to come after you, but also for your shareholders to come after you. It's unfathomably stupid, and that's what they did with regard to their commitment to the government on privacy. That's an issue of tremendous importance to their consumers. I think that Facebook is a lot less sticky than they think. It's already lost a lot of people, and exactly the people they need, the younger people. Basically, it's a lot of grandmas showing pictures of their grandchildren on there now. I think it's a tremendously risky moment for Facebook.

Now, how to have independent directors? There's only one way to do it, and that is to say that the non-Zuckerberg shareholders get to put some number of directors on the board; in other words, that he doesn't get to vote at all on those candidates.

Hill: Next week is the 10th anniversary of Motley Fool Money, which means that you and I first started talking around 10 years ago. When you look back at the world of corporate governance over the last 10 years, what do you think has been the biggest change for the better?

Minow: Biggest change for the better is definitely much more active, engaged, involved and capable board members. Boards have really stepped up to the plate much, much, much more than they did 10 years ago, partly because of changes in the law, partly because of changes in the culture. That has been very encouraging.

Hill: Before we get to the Academy Awards, I want to ask you a question about your job as a film critic. This week, the first teaser trailer for the movie Frozen 2 was released. I'm sure it's going to rake in a billion dollars. Increasingly, we're seeing these tentpole movies, many of which are sequels or remakes. I'm curious, in your job as a film critic, is peak happiness for you when you watch not just a great movie but a great original movie? Or is it just about how good it is, regardless of whether or not it's a sequel, regardless of the source material?

Minow: I'm going to tell you something that I think will really shock you. You've seen The Maltese Falcon, I assume?

Hill: Yes.

Minow: A classic by any definition, one of the greatest movies of all time. Do you know that was the third version of that movie?

Hill: Oh, no, I did not!

Minow: An earlier one starred Betty Davis.

Hill: [laughs] Well, now I have to go find that version.

Minow: [laughs] So, I'm hesitant to say that remakes and sequels can't be good. There's always the examples, The Maltese Falcon or The Godfather 2. Generally speaking, no. And the reason is risk assessment. If you're going to invest $75 million in any project, you want to minimize your risk. By having a known quantity, where the audience is already prepared, already interested, that's something that people like to invest in. That's always going to be something. We're seeing now all these gender-switched versions. That's the new trend. I'm happy to see that. I'm happy to see if they can find something new. I'm happy to see that Mary Astor is going to do a better job in the movie than even Betty Davis, which I would never have anticipated.

But, yeah, I certainly see so much of the same thing over and over and over that I'm always looking to be surprised and always very happy when I am surprised.

Hill: Let's get to the three biggest Academy Awards: Best Actor, Best Actress, Best Picture. As we always do, let's go through who you think should win and who you think will win. With Best Actor, you've got Randy Malik, who played Freddie Mercury. He's a first-time nominee and he's up against everyone else in the category who's either won an Academy Award before or has been nominated before -- Christian Bale, Bradley Cooper, Viggo Mortensen, Willem Dafoe, it's his fourth nomination. How do you see this playing out?

Minow: This is one of the toughest ones to call. I would definitely have said Christian Bale in Vice. He's won the preliminary awards. But he's been so Looney Tunes in his acceptances that sometimes I wonder if the Academy just wants to make sure that it's a good show. I was at the Critics Choice Awards when he gave his long, looping, crazy speech. He's probably still going to win, but that's because I think the rest of the lineup just isn't strong enough to beat him.

Hill: In Best Actress, it looks like Glenn Close is the betting favorite. Who do you think should win and who do you think will win?

Minow: Well, Glenn Close fits into one of the Academy's favorite categories, which is, Why Hasn't She Won An Award Before. She currently has the record for the most nominations without a win. The Wife is a great performance and a good movie. It's not her best performance by any means. But, again, I think she's the strongest one in the category. At the Critics Choice Awards, where I vote and where I was, it was a tie. Glenn Close and Lady Gaga. They turned out to be longtime friends. They were holding each other and weeping, it was very moving. So, that would be my hope for this Oscar, that we have another tie. But right now, it looks like Glenn Close.

Hill: There are eight films nominated for Best Picture. This is another category where it seems like one is the overwhelming betting favorite, and that's Roma. Is it Roma's to lose?

Minow: It's Roma. I'm telling you, people up there with your Oscar pools, this is the closest thing to a sure bet, other than Regina King as Best Supporting Actress, that we have this year. Roma has won all the preliminary awards. I think it may just win the Big Four. It may win director and cinematographer and best foreign, as well.

I am not a huge fan of Roma, so I'm not that enthusiastic about it, but I think it's the clear front runner. If it were up to me, the best film of last year isn't even on this list, and it should have been, and that's If Beale Street Could Talk by the same writer-director who did Moonlight. I thought that was one of the best films of the last five years. If you haven't seen that, I highly recommend it!

Hill: When it comes to the Academy Awards, any category, please fill in the blank. Don't be surprised if ____.

Minow: [laughs] Don't be surprised if Black Panther wins some of the lower-tier awards. They just could win production design, costume, and they certainly deserve it. Black Panther should have been nominated for more awards. It should have been nominated for Best Supporting Actor. I think it's going to pick up some awards for the crew.

Hill: One of the best reasons to be on Twitter is so you can follow Nell Minow and get her thoughts on corporate governance, movies, and a lot more. Nell, thanks for being here. Here's to the next 10 years.

Minow: [laughs] Absolutely! I'll be here. Bye bye!

__

Hill: Our email address is radio@fool.com. Great email this week from Juan Carlos Parra, who writes, "Hey, guys! Just wanted to tell you that I've been listening to your show every day while I'm delivering at work. I'm 22 years old and I just dipped my toe into the world of investing. I figured I could learn a lot by listening to your shows from the beginning, so I've started listening from the first episode of Motley Fool Money. I have to say, it's funny hearing your predictions. It's like I'm from the future."

Gross: That's awesome!

Cross: Well done!

Hill: That's fantastic! And hey, congrats to Juan Carlos for starting his investing journeys!

Moser: That's a great age to begin going!

Hill: It really is! All right, let's get to the stocks on our radar this week. Our man behind the glass, Dan Boyd, is going to hit you with a question. Ron Gross, you're up first, what are you looking at this week?

Gross: All right, Danny, I've got American Tower, AMT, which is a real estate investment trust or REIT. It's one of the largest owners of multitenant communication towers in the world. They provide a critical part of the infrastructure powering the digital revolution that we talk about so much. Great unit economics, really strong competitive advantage. A combination of a nice yield and dividend growth. They've grown that dividend the past 23 consecutive quarters. The dividend yield currently stands at 1.9%.

Hill: And the ticker symbol?

Gross: AMT.

Hill: Dan, question about American Tower?

Dan Boyd: Astute listeners will know that Ron has yet to sway me on any of these "stocks on our radar" segments.

Gross: [laughs] Is there a question here?

Boyd: You bring me communications towers?! Not even the communications towers themselves, but the company that owns them?!

Moser: Is there a -- well, I guess there is a question there.

Gross: It's a REIT, Dan! Did I mention that?

Boyd: You did! I'm still wondering why!

Hill: I think I know how this is going to play out. Jason Moser, what are you looking at this week?

Moser: I guess this is one that you probably want to steer clear of for now -- Zillow, ticker ZG. Earnings coming out on Thursday. I guess my biggest question is, when are these guys going to start reporting some meaningful profitability? I know they want to focus a little bit more now on this new-home segment of the business they have, but it's such a tiny fraction of the business at this point. It's losing money. It's just fluff. Don't even worry about it. I don't even know if it's going to be that much of a driver anyway.

Zillow is still really all about the premiere agent business, and that growth is actually slowing a little bit. We know that we're not going to get any firm numbers on how many agents they have, so focus on the growth in the agents that are spending more than $5,000. CEO Spencer Rascoff mentioned that churn was a bit high in 2018. They hope that it abates in 2019. But still, you look back at the course of this company's public life, and the financials are just atrocious. They have yet to report anything even close to profitable. I can't help but think, if we have a recession or a bad housing market, it's not going to play out well for these guys. I really just want to see some kind of light at the end of the tunnel there on Thursday.

Hill: Dan, question about Zillow?

Boyd: Well, this is great because, Jason, I'm a Zillow shareholder!

Gross: [laughs] Finally, maybe I win one!

Boyd: So, maybe not much of a question as just a request for commiseration, please.

Hill: Andy Cross, what are you looking at?

Cross: Dan, when you're on your next trip to Bermuda or the Cayman Islands, you have to put your money someplace. Go with Bank of N. T. Butterfield & Son, NTB --

Boyd: That's made up.

Cross: It's not made up. One of the oldest banks in Bermuda. They report earnings next week. The stock took a thumping after it reported a decline in deposits and some trouble with their Deutsche Bank Trust acquisition. I'm looking for some insights on how the deposit growth is going and what's going on with the Deutsche Bank acquisition.

Hill: Dan, Bank of N. T. Butterfield?

Boyd: Andy, what does the T stand for in N. T. Butterfield?

Cross: That's a good question, Dan! I know what the N stands for, it's Nathaniel. He's the founder's son from Bermuda when they founded the bank.

Hill: Three stocks. Dan, you got one you want to add to your watch list?

Boyd: I do, Chris, I'm going to head down to Bermuda.

Gross: Oh, come on!

Boyd: Hang out in the sun --

Gross: Now it's personal!

Cross: Collect that 4% yield!

Moser: It really felt like Ron was a shoo-in.

Gross: I was this close!

Moser: Now it's personal!

Boyd: Next time, buddy! Next time!

Hill: Guys, thanks for being here! Our engineer is Dan Boyd. Our producer is Mac Greer. I'm Chris Hill. Thanks for listening! We'll see you next week!

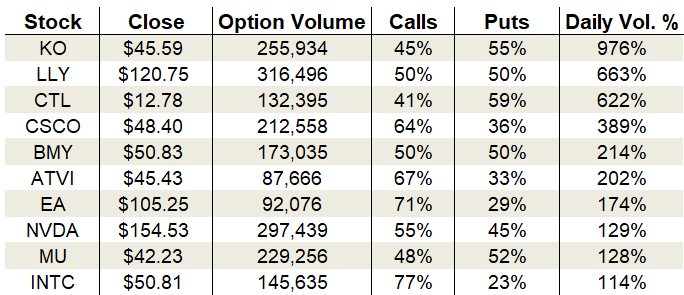

In the options pits, call buyers were still the busier bunch on Thursday, but the markets had a tizzy brought by the weakest retail sales report since 2009. We also had news that things are not going well with the China tariff deal. Now we are in a stalemate while we await the next meeting or headline. Wall Street is waiting for confirmation before they eliminate the risks from those fronts. The action was more cautious than Wednesday. We saw the options balance shift slightly more bearish, with only 18.1 million calls and 16.3 million puts during the session.

In the options pits, call buyers were still the busier bunch on Thursday, but the markets had a tizzy brought by the weakest retail sales report since 2009. We also had news that things are not going well with the China tariff deal. Now we are in a stalemate while we await the next meeting or headline. Wall Street is waiting for confirmation before they eliminate the risks from those fronts. The action was more cautious than Wednesday. We saw the options balance shift slightly more bearish, with only 18.1 million calls and 16.3 million puts during the session.

Vanguard Group Inc boosted its stake in Immune Design Corp (NASDAQ:IMDZ) by 0.7% during the 3rd quarter, HoldingsChannel.com reports. The institutional investor owned 1,615,442 shares of the biotechnology company’s stock after acquiring an additional 11,006 shares during the period. Vanguard Group Inc’s holdings in Immune Design were worth $5,574,000 at the end of the most recent quarter.

Vanguard Group Inc boosted its stake in Immune Design Corp (NASDAQ:IMDZ) by 0.7% during the 3rd quarter, HoldingsChannel.com reports. The institutional investor owned 1,615,442 shares of the biotechnology company’s stock after acquiring an additional 11,006 shares during the period. Vanguard Group Inc’s holdings in Immune Design were worth $5,574,000 at the end of the most recent quarter.