Thursday, October 31, 2013

Wednesday, October 30, 2013

Is UBS a Buy After Earnings?

With shares of UBS (NYSE:UBS) trading around $19, is UBS an OUTPERFORM, WAIT AND SEE, or STAY AWAY? Let's analyze the stock with the relevant sections of our CHEAT SHEET investing framework:

T = Trends for a Stock’s MovementUBS, a financial services firm, provides wealth management, asset management, and investment banking products and services worldwide. Its Wealth Management division provides financial services to high net worth individuals worldwide. Its Investment Bank division offers products and services in equities, fixed income, foreign exchange, and commodities to corporate and institutional clients, sovereign and government bodies, financial intermediaries, alternative asset managers, and its wealth management clients. UBS Asset Management division offers investment solutions to various asset classes.

UBS has reported a 577 million franc ($644.2 million) profit during the quarter, beating analyst estimates, but the Swiss bank also warned that legal costs could increase as UBS said it has received requests from various authorities regarding its foreign exchange businesses. Swiss authorities have demanded that UBS set aside more funds for litigation, and so UBS likely won't reach its 2015 profit goals. The results caused shares to drop in Swiss trading this morning.

T = Technicals on the Stock Chart are StrongUBS stock has remained in a range over the last five years. The stock is currently near highs for the year. Analyzing the price trend and its strength can be done using key simple moving averages. What are the key moving averages? The 50-day (pink), 100-day (blue), and 200-day (yellow) simple moving averages. As seen in the daily price chart below, UBS is trading above its rising key averages, which signal neutral to bullish price action in the near-term.

(Source: Thinkorswim)

Taking a look at the implied volatility (red) and implied volatility skew levels of UBS options may help determine if investors are bullish, neutral, or bearish.

| Implied Volatility (IV) | 30-Day IV Percentile | 90-Day IV Percentile | |

| UBS Options | 22.11% | 0% | 0% |

What does this mean? This means that investors or traders are buying a minimal t amount of call and put options contracts as compared to the last 30 and 90 trading days.

| Put IV Skew | Call IV Skew | |

| November Options | Flat | Average |

| December Options | Flat | Average |

As of today, there is an average demand from call buyers or sellers and low demand by put buyers or high demand by put sellers, all neutral to bullish over the next two months. To summarize, investors are buying a minimal amount of call and put option contracts and are leaning neutral to bullish over the next two months.

On the next page, let’s take a look at the earnings and revenue growth rates and the conclusion.

E = Earnings Are Mixed Quarter-Over-QuarterRising stock prices are often strongly correlated with rising earnings and revenue growth rates. Also, the last four quarterly earnings announcement reactions help gauge investor sentiment on UBS’s stock. What do the last four quarterly earnings and revenue growth (Y-O-Y) figures for UBS look like and more importantly, how did the markets like these numbers?

| 2013 Q2 | 2013 Q1 | 2012 Q4 | 2012 Q3 | |

| Earnings Growth (Y-O-Y) | 31.29% | -8.15% | -658.46% | -306.58% |

| Revenue Growth (Y-O-Y) | 17.92% | 14.54% | 9.54% | -5.10% |

| Earnings Reaction | 2.57% | N/A | N/A | N/A |

UBS has seen decreasing earnings and increasing revenue figures over the last four quarters. From these numbers, the markets have had mixed feelings about UBS’s recent earnings announcements.

P = Excellent Relative Performance Versus Peers and SectorHow has UBS stock done relative to its peers, JPMorgan Chase (NYSE:JPM), Goldman Sachs (NYSE:GS), Wells Fargo (NYSE:WFC), and sector?

| UBS | JPMorgan Chase | Goldman Sachs | Wells Fargo | Sector | |

| Year-to-Date Return | 25.48% | 20.04% | 27.10% | 25.07% | 25.42% |

UBS has been a relative performance leader, year-to-date.

ConclusionUBS, a financial services firm, provides wealth management, asset management, and investment banking products and services worldwide. The company might not reach its profit goals in 2015 since Swiss authorities demanded that they set aside more funds for litigation. The stock has been in a range over the last five years, however, it’s currently near highs for the year. Over the last four quarters, earnings have been decreasing while revenues have been increasing, which has produced mixed feelings among investors. Relative to its peers and sector, USB has been a relative performance leader year-to-date. Look for UBS to OUTPERFORM.

Saturday, October 26, 2013

Arrested Reporter in Zoomlion Case Admits To Taking Bribes And Inaccurate Reporting

In a dramatic turn of events, Chen Yongzhou, the arrested reporter from New Express, acknowledged to have taken bribes for publishing 14 articles that accused Zoomlion of fabricating sales, engaging in abnormal marketing activities and trading stocks that resulted in the loss of national assets.

"None of the articles was written by me," said Chen, who appeared in the news channel of Central China Television on Saturday morning. "They provided the original script and I edited it." Chen confessed to have conducted arranged interviews for only "one and a half" of the published pieces. For some of the rest, he did not even take a thorough look before they went to press. It was not made clear for whom Chen was working for, though he revealed to have been contacted by certain "middlemen."

Hot Heal Care Companies To Buy Right Now

The content of the articles was "absolutely not objective," according to Chen, given their "obvious" intention to tarnish the reputation of Zoomlion, China's second largest manufacturer of construction machinery.

Chen was also paid RMB 500,000 to report Zoomlion's "problems" using his real identity to the Hong Kong Stock Exchange, the Securities and Futures Commission of Hong Kong and the China Securities Regulatory Commission.

Chen said he became afraid after trading of Zoomlion's stocks was suspended for two days in May, following a major piece that alleged the company had fabricated sales. Zoomlion lost RMB 1.4 billion in just one day, according to an executive interviewed in the TV program. "[The impact] was completely beyond my expectation," Chen confessed, though he published four more articles thereafter.

Chen, based in Guangzhou, Guangdong Province, was arrested on Oct 19th on charges of "damaging commercial reputation" by police from Changsha, Hubei Province, where Zoomlion is based. His employer New Express has since made public appeals for Chen's release and claimed that review of his articles showed none but one factual mistake. "Based on our investigation and knowledge, Chen Yongzhou has not violated the ethics of news reporting or laws in the coverage of Zoomlion's financial issues." New Express wrote in a public statement on October 23rd.

Chinese media and online commentators have previously questioned the legality of Chen's arrest by police force from a different province and the charges made against him. It was also questioned if New Express, not Chen, should be the one that bears the brunt of legal actions.

Phone calls to New Express' office went unanswered.

Follow me on Twitter @Hengshao90.

Friday, October 25, 2013

How Congress Uses Donor Money as Slush Funds

Apparently an annual salary of $174,500 and a vast array of taxpayer-funded perks is not enough for most members of Congress.

Otherwise, why would they need "Leadership PACs" - personal political action committees that supposedly raise money for political activities but in practice provide a pipeline of cash to subsidize their already-elite lifestyle.

Now remember, in addition to official salaries more than triple what the average American household earns, members of Congress have an average net worth of about $966,000, according to OpenSecrets.org.

And yet these greedy elitists still feel the need to siphon off some political donations to pay for luxuries they could easily afford anyway.

As Trevor Potter, a former chairman of the Federal Election Commission (FEC), told "60 Minutes," Leadership PAC money "can be used for literally anything."

By law - a law Congress wrote and passed - Leadership PAC money has but a single limitation: It cannot be spent directly on the PAC owner's own election campaign.

How convenient...

"You can use [Leadership PACs] for babysitting..., you can use them for paying for car service. You can use them for travel," Peter Schweizer, a fellow at the Hoover Institution, told CBS News "60 Minutes" in a segment broadcast on Sunday. Schweizer's book on the topic, Extortion: How Politicians Extract Your Money, Buy Votes and Line Their Own Pockets, comes out today (Tuesday).

Some lawmakers have used their Leadership PAC money to entertain friends on elite golf courses or to treat them to NFL games.

"It's a political slush fund," Potter told "60 Minutes." "Over time, we've had them. They've been outlawed. They spring back in new guises, and this is the latest guise."

And that's not all. When members of Congress leave office, they can keep their Leadership PAC money and use it for their second career as a lobbyist, or in retirement to finance the maintenance of old political connections.

As long as they can dream up a political pretext for spending the money, no matter how vague or stretched, it's a "legitimate" Leadership PAC expense.

Where Leadership PACs Came FromAccording to the "60 Minutes" segment, Leadership PACs were invented specifically to bypass the Ethics Reform Act of 1989, which stated that campaign funds could not be converted for personal use.

At first only the most senior members of Congress had Leadership PACS, which originally were set up to raise money that could be distributed to other members of their party to secure political alliances and ensure the election of those allies.

But now nearly every U.S. senator - and about two-thirds of the House of Representatives - has a Leadership PAC.

Leadership PACs have become so de rigueur, in fact, that incoming members of Congress now create them before they're even sworn into office.

Some don't even wait to get elected.

Newark Mayor Cory Booker, who just last week won the open seat left by the death of Sen. Frank Lautenberg, D-NJ, created his Leadership PAC in June - of 2011.

And because Leadership PACs are so handy, they enjoy full bipartisan support. While their political brinksmanship forced a government shutdown earlier this month, Republicans and Democrats hold identical positions on political slush funds: They love them.

And it's easy to see why. In addition to providing supplemental income, Leadership PACs allow members of Congress to double-dip from donors who had already given the legal maximum to their regular campaign fund.

The few legislative attempts to restrict the personal use of Leadership PAC funds have been routinely ignored.

What Leadership PAC Money Gets Spent OnLet's have a look at some of the frills our elected officials have spent their Leadership PAC donations on:

Rep. Ander Crenshaw, R-FL, spent $32,000 in Leadership PAC money to take some defense industry donors on a tour of some California wineries. Rep. Robert Andrews, D-NJ, spent $16,000 to fly his family to Scotland for the wedding of a friend that he was considering hiring as a political consultant. Sen. Saxby Chambliss, R-GA, spent $100,000 over the past two years treating his political cronies to some of world's top golf courses. Rep. George Meeks, D-NY, dropped $35,000 on tickets to NFL games for his friends' football watching pleasure. Disgraced presidential candidate Sen. John Edwards, D-NC, used $114,000 to pay mistress Reille Hunter to make a campaign video. In one case, the misuse of funds extended beyond even the lawmaker's death. In 2007, after Rep. Paul Gillmor, R-OH, died suddenly from a heart attack, his staff spent his Leadership PAC money on dinners and pizza parties.And there are other abuses.

"60 Minutes" noted that many members of Congress also use Leadership PAC money to hire relatives to work on their campaigns.

And the Citizens for Responsibility and Ethics in Washington (CREW) found that at least 15 members of Congress have loaned their campaign funds money, then charged ridiculously high interest rates.

Such schemes can yield serious money, but the profits come directly out of the pockets of their unsuspecting contributors.

One enterprising congresswoman, Rep. Grace Napolitano, D-CA, loaned her campaign $150,000 at 18% interest. Over 12 years, she collected a tidy $228,000.

"Congress has created this domain that allows them to decide whether something is ethical or whether something is good," Schweizer said. "And it's another example, unfortunately, where the rules that apply to the rest of us don't really apply to members of Congress."

Are you outraged over Congressional abuse of Leadership PAC money? Are you tired of an ineffective government run by a privileged class that has forgotten what it's like to be a hard-working, struggling citizen? Go here to tell Washington how you really feel!

Related Articles:

Money Morning:Congress Handing Out Stock Tips to Hedge Fund Managers Money Morning:

How the Richest Members of Congress Made Their Fortunes Money Morning:

While the Middle Class Suffers, Congress Is Getting Richer - With Help from Legal Insider Trading CBS News:

Washington's Open Secret: Profitable PACs CREW:

CREW and 60 Minutes Expose Another Congressional Scheme

Wednesday, October 23, 2013

Is Your Superstore Retailer Digital Proof?

There's a digital divide among superstore chains in an era where digital delivery is rendering a lot of physical selling space obsolete.

In this video, longtime Fool contributor Rick Munarriz explains why Bed Bath & Beyond (NASDAQ: BBBY ) and Costco (NASDAQ: COST ) are holding up well at a time when Barnes & Noble (NYSE: BKS ) and Best Buy (NYSE: BBY ) are turning to dramatic makeovers to remain relevant.

Learn to profit from retail's changing ways

To learn about two retailers with especially good prospects, take a look at The Motley Fool's special free report: "The Death of Wal-Mart: The Real Cash Kings Changing the Face of Retail." In it, you'll see how these two cash kings are able to consistently outperform, and how they're planning to ride the waves of retail's changing tide. You can access it by clicking here.

Hot Safest Stocks To Invest In Right Now

Tuesday, October 22, 2013

5 Best Biotech Stocks For 2014

The GuruFocus special feature 52-week low Value Screen is a great research tool to help investors quickly sort through the 740 USA stocks currently listed at a 52-week low, not to mention thousands of other stocks around the world.

Today�� focus is on stocks that are a little more than 50% off high in a 52-week low, along with company financial updates from the second quarter of 2013.

Investor billionaires are holding some of these stocks:

Dendreon Corp. (DNDN)

The current DNDN share price is $3.39, or 53% off the 52-week high of $7.22.

Down 27% over 12 months, Dendreon Corp. (DNDN) has a market cap of $534.26 million, and trades at a P/S of 1.63.

Dendreon is a biotechnology company focused on the discovery, development and commercialization of novel therapeutics that improve cancer treatment options for patients. Its product portfolio includes active cellular immunotherapy and small molecule product candidates.

Revenue and net income tracking:

5 Best Biotech Stocks For 2014: Neoprobe Corporation(NEOP)

Neoprobe Corporation, a biomedical company, engages in the development and commercialization of precision diagnostics that enhance patient care and improve patient benefit. The company is developing and commercializing targeted agents aimed at the identification of occult (undetected) disease. Neoprobe?s two lead radiopharmaceutical agent platforms, Lymphoseek and RIGScan are intended to help surgeons better identify and treat certain types of cancer. Lymphoseek is a diagnostic imaging agent intended for radiolabeling and administration in radiodetection and visualization of the lymphatic system draining the region of injection for delineation of the lymphatic tissue; and RIGScan is an intraoperative biologic targeting agent consisting of a radiolabeled murine monoclonal antibody. The company has a biopharmaceutical development and supply agreement with Laureate Biopharmaceutical Services, Inc. to support the initial evaluation of the viability of the CC49 master working c ell bank, as well as the initial steps in re-validating the commercial production process for the biologic agent used in RIGScan CR. The company was founded in 1983 and is based in Dublin, Ohio.

5 Best Biotech Stocks For 2014: Sanofi(SNY)

sanofi-aventis engages in the discovery, development, and distribution of therapeutic solutions to improve the lives of everyone. The company offers a range of healthcare assets, including a broad-based product portfolio in prescription drugs, OTC/OTX, generics, vaccines, and animal health. It has a strategic alliance with Regulus Therapeutics Inc. to discover, develop, and commercialize micro-RNA therapeutics, initially in fibrosis. The company was founded in 1970 and is headquartered in Paris, France.

Advisors' Opinion:- [By Stephen Simpson, CFA]

If there's a downside to Lexicon's partnering opportunities, it's that there aren't many obvious partners left. Unless one of the existing companies in the SGLT space chose to abandon an existing partnership, Novo Nordisk, Roche (RHHBY.OB), and Takeda may be the best candidates to partner with Lexicon, and that's the sort of limited pool that can lead to hard bargaining. Sanofi (SNY) may also belong in this pool as well, though. While the company did reach a licensing agreement with Chugai for an SGLT2 inhibitor in Japan, that agreement was limited in scope and the drug does not appear on Sanofi's August 2013 pipeline chart.

- [By Brian Orelli]

There are a few reasons doctors haven't flocked to prescribe Qsymia in large numbers:

One bitten, twice shy. It's not particularly surprising that doctors might be a little tentative about prescribing an obesity drug, considering how previous obesity drugs have fared. Wyeth's fen-phen, Abbott Labs' (NYSE: ABT ) Meridia, and Sanofi's (NYSE: SNY ) Acomplia were all pulled off the shelves after side effects were discovered. Meridia's heart issues were uncovered in a post-marketing clinical trial. Acomplia never made it to market in the U.S., and European regulators pulled it off the market after real-world usage showed less efficacy and more-common psychiatric side effects.

It costs what? There are probably some patients not taking the drug simply because of the cost. Only one third of patients with insurance have coverage for Qsymia, and many of those are at the Tier 3 level, where copays are higher, typically $50 to $100. VIVUS is shooting for having 50% coverage of people on private insurance by end of the year, which should help with sticker shock, as have the free trials and discount drugs for those not covered by insurance.

Not for sale (here). When Qsymia launched last year, the Food and Drug Administration limited its sales to mail-order pharmacies. While it's arguably more convenient to get drugs delivered to your doorstep, ordering through a mail-order pharmacy requires more initial effort than purchasing drugs at a local pharmacy. Fortunately last month, the FDA told VIVUS it could start selling Qsymia in retail pharmacies, which will begin by mid-July.VIVUS has spent lots of money jumping over hurdles to make the drug more appealing to patients. And it plans to spend more launching a direct-to-consumer print and digital media campaign. With any luck, VIVUS will be able to find a partner to help pay for the investment. It certainly isn't cheap, and there aren't any guarantees of making it back.

Hot Oil Stocks To Own Right Now: Incyte Corporation(INCY)

Incyte Corporation focuses on the discovery and development of proprietary small molecule drugs for hematologic and oncology indications, and inflammatory and autoimmune diseases. Its product pipe line includes INCB18424, which is in Phase III clinical trial for myelofibrosis; Phase III trial for polycythemia vera; Phase III trial for essential thrombocythemia; Phase I/II trial to treat solid tumors/other hematologic malignancies; and Phase IIb trail for the treatment of psoriasis. The company?s portfolio also includes INCB28050, a Phase IIb clinical trial product for rheumatoid arthritis; INCB28060, a Phase I/II product for solid tumors; INCB7839, a Phase II product for breast cancer; and INCB24360, a Phase I/II product for solid tumors. It has a collaborative research and license agreements with Novartis International Pharmaceutical Ltd.; Eli Lilly and Company; and Pfizer Inc. The company was founded in 1991 and is headquartered in Wilmington, Delaware.

Advisors' Opinion:- [By Paul Ausick]

Big earnings winners: Incyte Corp. (NASDAQ: INCY) up 34.4% to $36.02 on a successful drug trial, Target Corp. (NYSE: TGT) down 3.5% to $65.54 on weak earnings and lowered outlook, and Lowe�� Companies Inc. (NYSE: LOW ) up 4.4% at $46.01 on strong earnings and an improved outlook.

- [By Maxx Chatsko]

The best part about being a buy-and-hold investor is that when volatility strikes and analysts and pundits are panicking, you can calmly go about your business and steal great companies at bargain prices. One of the stocks on my top watchlist is Incyte (NASDAQ: INCY ) , which is a growing biotech company focused on developing oncology and anti-inflammatory drugs. The company's shares have recently fallen below $20 for the first time since early February, which I think warrants a deeper look. In the following video, I'll break down the pros and cons of adding Incyte to your portfolio, although I think the company has a lot of potential in its pipeline.

- [By John McCamant]

Incyte's (INCY) crackerjack medicinal chemistry team continues to show that they can create better and differentiated drug candidates from the competition.

The key near-term driver for INCY is Jakafi growth, and with the increased sales guidance, the company is delivering. The drug's overall profile continues to improve and the recent survival data proves that Jakafi does much more for myelofibrosis patients than just control symptoms.

5 Best Biotech Stocks For 2014: Dendreon Corporation(DNDN)

Dendreon Corporation, a biotechnology company, engages in the discovery, development, and commercialization of therapeutics to enhance cancer treatment options for patients. The company offers active cellular immunotherapy and small molecule product candidates to treat various cancers. Its product candidates comprise Provenge (sipuleucel-T), an active cellular immunotherapy for the treatment of metastatic, castrate-resistant prostate cancer; DN24-02, an investigational active immunotherapy for the treatment of patients with bladder, breast, ovarian, and other solid tumors expressing HER2/neu; and TRPM8, a small molecule agonist to transient receptor potential ion channel, for multiple cancers. The company also has a range of products in preclinical studies, which include Carcinoembryonic antigen for the treatment of lung, colon, and breast cancer; and Carbonic AnhydraseIX for the treatment of kidney cancer. Dendreon Corporation was founded in 1992 and is headquartered in S eattle, Washington.

Advisors' Opinion:- [By Dan Caplinger]

On Thursday, Dendreon (NASDAQ: DNDN ) will release its latest quarterly results. The key to making smart investment decisions on stocks reporting earnings is to anticipate how they'll do before they announce results, leaving you fully prepared to respond quickly to whatever inevitable surprises arise. That way, you'll be less likely to make an uninformed kneejerk reaction to news that turns out to be exactly the wrong move.

- [By Sean Williams]

This week's winner

Although there was no company-specific news out of�Dendreon (NASDAQ: DNDN ) this week, following weeks of poor performance, it tacked on 8.7%. Presentations at the American Society of Clinical Oncology's annual meeting two weeks ago certainly helped to excite investors with regard to the potential of immunotherapy stocks, but Dendreon needs a lot more help than what a few early and mid-stage studies can offer. If Dendreon is to keep this rally going, it'll need decisively positive data on advanced prostate cancer treatment Provenge in Europe. We should certainly know more about its progress in Europe within the next few months. - [By David Hanson]

8. Dendreon (NASDAQ: DNDN ) Many investors consider biotech investing too volatile and too risky. If you have followed Dendreon's stock performance over the last five years, you probably wouldn't argue with that notion. The company does not have a huge basket of drugs to bolster earnings while developing new home-run products. As the company continues to burn through cash and be weighed down by debt, the threat of shareholder dilution will keep many major investors, including Buffett, far away from the stock.

- [By Rich Smith]

This series, brought to you by Yahoo! Finance, looks at which upgrades and downgrades make sense, and which ones investors should act on. Today, our headlines include a new buy rating for Workday (NYSE: WDAY ) , a higher price target for Raytheon (NYSE: RTN ) , and a lower one for Dendreon (NASDAQ: DNDN ) . Let's dive right in.

5 Best Biotech Stocks For 2014: Fuse Science Inc (DROP.PK)

Fuse Science, Inc. ( Fuse Science), incorporated on September 21, 1988, is a consumer products holding company. The Company maintains the rights to sublingual and transdermal delivery systems for bioactive agents that can effectively encapsulate and charge many varying molecules in order to produce complete product formulations which can be consumed orally, applied topically or delivered otherwise sublingually or transdermally, thereby bypassing the gastrointestinal tract and entering the blood stream directly. The Fuse Science technology is designed to accelerate conveyance of medicines or nutrients relative to traditional pills and liquids and can enhance how consumers receive these products. In December 2012, the Company launched its initial DROP products, PowerFuse, an energy formulation in a concentrated drop and ElectroFuse, an electrolyte formula in a concentrated drop, online, with the expansion into targeted retail distribution channels.

The Compan y is developing formulations and devices, which are compatible with alternative delivery systems for energy, medicines, vitamins and minerals, among other bioactives. These alternative systems include, but are not limited to, sublingual, transdermal and buccal drug delivery methods. use Science has developed and continues to advance, in conjunction with its scientific team, sublingual and transdermal delivery systems for bioactives that can effectively encapsulate and charge varying molecules in order to produce product formulations which can be consumed orally, applied topically or otherwise delivered sublingually or transdermally, thereby bypassing the gastrointestinal tract and entering the blood stream directly. The delivery technology is consists of encapsulation vesicles and ion exchange permeation enhancers. This technology utilizes a gradient across the mucosa membrane to help deliver the bioactive more efficiently through the mucosa.

The Company

Sunday, October 20, 2013

Is a Type 1 Diabetes Cure Right Around the Corner?

For lack of a better phrase, those who have type 1 diabetes -- a form of diabetes whereby the person's own autoimmune system attacks or attempts to destroy cells in the pancreas responsible for producing insulin -- often get the short end of the stick.

Despite being the most common chronic disease in children, type 1 diabetes accounts for just 5% of all diabetes diagnoses. The remaining 95% are type 2 diabetics who see their glycemic imbalance brought upon because of a number of factors including genetic make-up, and a number of behavioral habits like smoking or obesity caused by poor diet or lack or exercise. With the pendulum swinging so decisively toward type 2 diabetes in number of diagnoses, it's not surprising to see so many pharmaceutical companies focusing their efforts on developing new type 2 medications.

That pendulum, though, may be ready to swing back in the other direction.

In one of the more exciting studies I've witnessed over the past few years, a research team at Boston Children's Hospital released its findings via a blog post last week that it had discovered the pathway responsible for causing type 1 diabetes. After testing hundreds of different pathways in animals, researchers, identified the ATP/P2X7R pathway as the one responsible for triggering T-cell attacks on the pancreas that render it incapable of producing insulin.

It's all about treating the symptoms

Source: Sarah G., Flickr.

As of right now, the primary treatment option associated with type 1 diabetes is insulin, as well as maintaining a healthy lifestyle through proper diet and exercise. Insulin comes in various forms, from the rapid-acting type to longer-lasting insulins.

Eli Lilly's (NYSE: LLY ) Humalog, for example, is one of the most widely used rapidly acting insulins. Its duration time is only three to five hours, but it'll peak in effectiveness in as little as 30 minutes. It was also responsible for $2.4 billion, or 11%, of Eli Lilly's total pharmaceutical sales last year and works well if taken while a meal is being consumed.

Best Stocks To Invest In

On the other end of the spectrum is Sanofi's (NYSE: SNY ) Lantus, which is a once-daily injection that can work in the body for up to 20-24 hours, but can also be combined with a short-acting insulin if needed. Lantus has been an absolute blockbuster diabetes drug up until now, garnering worldwide sales of more than $6 billion in 2012.

Another big beneficiary from type 1 diabetes is glucose-monitoring device makers. Perhaps the most exciting product in this space is Bayer's (NASDAQOTH: BAYRY ) Contour Next Link. Bayer has partnered its device with Medtronic (NYSE: MDT ) in such a way that it'll connect wirelessly to Medtronic's insulin pump, drastically reducing many instances of human error or forgetfulness, and delivering the right dosage of insulin to patients throughout the course of the day.

Soon, we may be curing the disease

But, the truth of the matter is that these are treatments for the symptoms associated with type 1 diabetes; they aren't cures. The research conducted at Boston Children's Hospital offers the possibility of an actual cure if a medication can be developed that suppresses autoimmune dysfunction based on this specific pathway. Admittedly, we could be looking at half a decade or longer before there's a big enough human trial to validate whether a cure can be derived, but this is exciting news nonetheless.

It would also make a lot of sense for a company like Eli Lilly or Sanofi to lead the way in terms of type 1 diabetes research, as Lilly's Humalog is set to lose patent protection next year and Sanofi's patents will expire in 2014/2015. These two pharmaceutical giants would love to replace the revenue that's almost certain to be lost because of generic competition. Building upon Boston Children Hospital's research could be one way of accomplishing this.

While we're still quite a ways from a cure, type 1 diabetes patients certainly have a reason to be a little more hopeful as it appears researchers are now one step closer.

With two of its top three drugs poised to lose patent protection this year, is Eli Lilly a dividend stock headed nowhere fast? In a new premium report, The Motley Fool's senior pharmaceuticals analyst breaks down all of Lilly's moving parts, including an in-depth analysis of the company's must-know opportunities and reasons to buy and sell today. To find out more click here to claim your copy today.

Saturday, October 19, 2013

Report: The greatest NFL comeback teams

Most teams with bad years tend to require a number of years to improve (if they improve at all, that is). If the Chiefs continue their improbable success, they could become one of those rare franchises that bounces back straight to the top — appearing in the Super Bowl. Looking through the history of the modern Super Bowl era, 24/7 Wall St. reviewed the eight teams that managed to come back from a losing season to make it all the way to the Super Bowl.

Sometimes, a disappointing season can actually improve a team's chances of making the Super Bowl. A terrible year, or years, can often lead management to clean house, firing coaches and making trades. In 2002, the Carolina Panthers fired George Seifert after an abysmal 1-15 season. His replacement, John Fox, ended up leading the team on a Super Bowl run two seasons later.

A bad year can also boost a team's chances in the form of new star players. Fans know this because the worst teams are allowed to pick earlier in the draft after a season concludes. So, the 15-loss Panthers were allowed to select second overall. They used this pick to draft future star defensive end Julius Peppers, who became a major part of the following year's Super Bowl team.

24/7 Wall St.: The 11 countries with perfect credit

For some of these comeback teams, the Super Bowl run was just the first sign of years of success. Going into the 1999 season, the St. Louis Rams had not had a winning season in nearly a decade. That team, which became known as the "greatest show on turf" for its high-powered offense, won the Super Bowl that year, played in another two years later, and made the playoffs in four of the next five seasons.

On the o! ther hand, there are comeback teams on this list that ended up being flashes in the pan. The 1998 Atlanta Falcons came back from two losing seasons to go 14-2 and lose Super Bowl XXXIII. Instead of riding on that success, the team then missed the playoffs in each of the next three years.

24/7 Wall St.: America's favorite Halloween candy

8. 1998 Atlanta Falcons

>Year made Super Bowl: 1999

>Previous year record: 7-9

>Super Bowl season record: 14-2

>Won Super Bowl?: no

After the Falcons' remarkably bad 1996 season in which they lost 13 out of 16 games, the team fired head coach June Jones, and veteran Dan Reeves took over the role. The next year, the team started the season by winning only one of its first eight games, but ended the season strong. The 1998 Falcons are the only team in Atlanta's nearly five decade history to make the Super Bowl. That year, they were undefeated at home, scored more points than in any previous season, won more games than in any other season in the franchise's history, and won their first division. Behind running back Jamal Anderson's 1,846 rushing yard season, the Falcons made it to the Super Bowl, where they eventually lost to John Elway's Broncos 34-19.

7. 2003 Carolina Panthers

>Year made Super Bowl: 2004

>Previous year record: 7-9

>Super Bowl season record: 11-5

>Won Super Bowl?: no

The Panthers' 2001 season was the worst in team history up to that point, with the Panthers winning just one game all year. This proved to be the last season of head coach George Seifert's career. That awful season, however, eventually paid dividends for the team, allowing it to select star defensive end Julius Peppers second overall in the 2002 draft. The following year, the team, under coach John Fox, showed some promise despite going on an 8-game losing streak in the middle of the season. In 2003, only two years removed from one of the worst records in NFL history, quarterback Jake Delhomme and the team went on t! o win 8 o! f the first 10 games. The Panthers finished the season with an 11-5 record, but lost Super Bowl XXXVIII to the Patriots in an exciting 32-29 close game.

6. 1981 Cincinnati Bengals

>Year made Super Bowl: 1982

>Previous year record: 6-10

>Super Bowl season record: 12-4

>Won Super Bowl?: no

24/7 Wall St.: The least tax-friendly states for business

After three losing seasons, during which the Bengals won a total of only 14 games, the team was headed by three different coaches. But the team started the 1981 season fresh, with brand new uniforms that included the Bengals' distinctive and still in use tiger-striped helmets. Wide receiver Cris Collinsworth, who was drafted in the offseason, proved to be a good target for veteran quarterback Ken Anderson. Together, they had eight touchdown passes and over 1,000 receiving yards during the regular season. Cincinnati finished the season 12-4, the best record in the AFC. The Bengals lost Super Bowl XVI to the San Francisco 49ers, another team making an impressive comeback from the previous year.

5. 1996 New England Patriots

>Year made Super Bowl: 1997

>Previous year record: 6-10

>Super Bowl season record: 11-5

>Won Super Bowl?: no

In the 10 years Prior to the Patriots' 1997 Super Bowl appearance, the team only made the playoffs twice. The Patriots went into the 1996 season after a 6-10 record in 1995, but showed some promise in the form of running back and Offensive Rookie of the Year Curtis Martin. In spite of growing tensions between head coach Bill Parcells, who resigned at the end of the season, and owner Robert Kraft, the Patriots had the second best record in the AFC. The then-underdog team continued to play in the Super Bowl where it was defeated by the Green Bay Packers.

4.1981 San Francisco 49ers

>Year made Super Bowl: 1982

>Previous year record: 6-10

>Super Bowl season record: 13-3

>Won Super Bowl?: yes

In 1978 and 1979, the 49ers had the wors! t record ! in the league, winning only two games in both seasons. After the '78 season, the team drafted future Hall of Fame quarterback Joe Montana 82nd overall. In 1980, the 49ers finished the regular season second to last in the NFC West. Draft picks Eric Wright, Carlton Williamson, and 2000 Hall of Fame inductee, Ronnie Lott helped improve the 49ers' defense and turn around the losing team's record for the 1981 season. These players were among the defensive line that performed perhaps the most famous goal-line stand in NFL history to win Super Bowl XVI against Cincinnati. San Francisco's 1981 season was also quarterback Joe Montana's first full season as starter. He went on to lead the 49ers to four Super Bowl wins, and is tied with Terry Bradshaw for the most titles of any NFL quarterback.

3. 2000 New York Giants

>Year made Super Bowl: 2001

>Previous year record: 7-9

>Super Bowl season record: 12-4

>Won Super Bowl?: no

The years leading up to the Giants' comeback season were riddled with inconsistency. This was particularly true in the quarterback position, for which the team had multiple replacements in just a few years. The Giants had only one winning season in the five years before 2000. Even at the beginning of the 2000 season, the team was expected to finish last. Quarterback Kerry Collins, who was picked up by the Giants in 1999, took over from Kent Graham that year and started the next season. Collins, however, could not handle the Ravens' defense in Super Bowl XXXV, which New York lost 34-7.

2. 2001 New England Patriots

>Year made Super Bowl: 2002

>Previous year record: 5-11

>Super Bowl season record: 11-5

>Won Super Bowl?: yes

The 2000 Patriots — led for the first time by new hire, head coach Bill Belichick — finished dead last in the AFC East after the regular season. The 2001 season was not looking to turn much better when quarterback Drew Bledsoe was hospitalized with serious internal injuries early in the season. This was! a blessi! ng in disguise, however, for it opened the position for the future hall-of-famer Tom Brady. After winning a controversial victory over the Vikings in the Divisional Playoffs, Brady led the Patriots through one of the biggest Super Bowl upsets in NFL history over the "Greatest Show on Turf" St. Louis Rams.

1. 1999 St. Louis Rams

>Year made Super Bowl: 2000

>Previous year record: 4-12

>Super Bowl season record: 13-3

>Won Super Bowl?: yes

Prior to 1999, the Rams had endured nine losing seasons under four different head coaches. Over this period of time, the Rams underwent numerous transitions, including a home-town change from Los Angeles to St. Louis. The Rams made a number of strong acquisitions for the 1999 season, including new a Marshall Faulk and Trent Green. Faulk would go on to be essential to the Ram's high powered offense that year. Green, however, sustained a crippling knee injury in the preseason and had to be replaced by an unknown and inexperienced Kurt Warner. Warner would excel, however, and During the regular season, the Rams scored nearly 20 points more than their opponents, on average. The team would come to be regarded as one of the most dominant offenses in NFL history. The Rams finished the season with the best record in the NFC, and went on to win the Super Bowl.

24/7 Wall St. is a USA TODAY content partner offering financial news and commentary. Its content is produced independently of USA TODAY.

Friday, October 18, 2013

Fiserv Brings Model Portfolio Data to Unified Wealth Platform

Fiserv announced earlier this month the launch of Model Management: Reporting, a module that provides investment managers with model portfolio data within the company’s Unified Wealth Platform.

The new module from Fiserv (FISV), a financial services technology solutions company based in Brookfield, Wis., provides investment managers data about the use of their models-only portfolios by participating broker-dealer sponsor firms.

Reported data as provided by the sponsor firms includes assets under management, weekly and monthly asset flows and information about the financial advisors using the models. In addition, an optimized login process provides single sign-on access to the middle-office component of the Fiserv platform.

Hot Biotech Stocks To Invest In 2014

“This technology gives investment manager clients access to key metrics about the use, penetration and movement of their portfolios,” said Cheryl Nash, Fiserv’s president of Investment Services, in a statement. “With the largest lineup of models-only sponsors in the industry, this data enables managers to measure their models’ penetration in a particular region or financial advisor, allowing them to measure their performance relative to competitors.”

Managers like the module’s timeliness, transparency and year’s worth of rolling data, while sponsors like the efficiency of the application since they don’t have to provide data and maintain email lists of their managers anymore, according to Michael Snizek, product manager of Investment Services.

“Once additional sponsors begin to use this component of Model Management from Fiserv, managers will be able to retrieve timely, accurate data that provides powerful insight into the use of their funds,” Snizek said in a statement. “With more than 60 managers already using the technology, we’ll be able to readily add additional managers, making Model Management: Reporting a very robust source for models-only manager data.”

Read Fiserv Launches Online Retirement Illustrator Tool at ThinkAdvisor.

Thursday, October 17, 2013

7-Eleven to sell upscale wines in some stores

Well, not exactly. But the nation's biggest convenience store chain, perhaps best-known as a place to grab a cold beer or a Slurpee, has quietly begun to sell ultra-premium wines at about $19.99 at 700 locations in 16 states.

The move is a serious bid to appeal to upper-scale Millennials whose business is crucial to the store's growth. It's also part of a broader, long-term strategy to attract more upscale customers to 7-Eleven stores. Just last month, the chain began selling better-for-you snacks including organic trail mix.

Sure, 7-Eleven may be better-known for carrying $3.99 bottles of Yosemite Road wine, "but we have to take care of our more affluent guests, too," says Alan Beach, vice president of merchandising.

10 Best Dividend Stocks To Invest In Right Now

For the holidays, 7-Eleven will even be selling a $54.99 bottle of Stag's Leap wine at about 300 stores. Consider, an average bottle of wine currently sold at 7-Eleven costs about $6.

Behind the wine surge at 7-Eleven: changing generational tastes away from beer towards wine. Wine sales domestically have grown for 19 years straight, says the Wine Institute. Wine consumption grew 21% between 2001 and 2011, reports the Beverage Information Group.

As wine becomes more mainstream, says Joe Czerwinski, managing editor of digital and print at The Wine Enthusiast, "it's subject to the same sort of impulse buying as other grocery items."

At the same time, Czerwinski notes, wine buyers tend to spend more per shopping basket than non-wine buyers, "so there may be expectations of some spillover effect."

For 7-Eleven, it's a no brainer. Unlike the guy who just pops in for a Slurpee and bag of chips, the gal who comes in for a bottle of upscale wine also might want to purchase a six-pack of its $8.99 Blue Moon craft beer, or even some of 7-Eleven's $20 iPhone chargers.

The A-list ! wines now at select 7-Eleven's: La Crema Chardonnay, Louis Martini Cabernet Sauvignon, Kim Crawford Sauvignon Blanc and Wild Horse Pinot Noir.

"We will see more of our stores adding premium and super-premium wines as demand increases," says Beach. Some 7-Eleven's that formerly carried just a dozen, or so, wines will now carry up to 40 varieties, he says.

Among the markets selling the upscale wines: San Francisco, Newport Beach, Ca., some Chicago suburbs and parts of Northern Virginia.

The target is younger consumers, age 21 to 34, whose incomes exceed $65,000.

The fancy wine is getting fancy in-store displays, too, under the banner, "Fine Wines Under $19.99."

In November and December, 300 7-Eleven stores will be selling the even more-upscale luxury wines that fetch $20 to $54.99.

Beach projects this will drive-up 7-Eleven's wine business for the holidays.

And that, he knows, is a lot of Big Gulps.

Tuesday, October 15, 2013

Apple Expected to Unveil New iPad (AAPL)

In typical Apple (AAPL

) fashion, the company has invited media to a mysterious event set for Tuesday, October 22nd.

) fashion, the company has invited media to a mysterious event set for Tuesday, October 22nd.

The invitation reads “we still have a lot to cover” with the Apple logo through out the image. This is par for the course for a new product announcement, as Apple has often waited until the last minute to invite media to launch events, and refuses to officially call them “launch events” ahead of time.

This time around it is widely expected that the company will draw the shades on its latest iPad iteration. The launch will be particularly crucial, as the tablet space has become crowded in recent years, threatening Apple’s market share. As usual, analysts and users are expecting higher speeds, thinner designs and an improved display from the yet-to-be released product.

Apple shares were up $2.98, or 0.6%, at Tuesday’s close. The stock is down just over 6% YTD.

Sunday, October 13, 2013

Weekend Edition – Dividend Quirks From Abroad

Top 5 Oil Companies To Watch In Right Now

On Friday, while writing up an overview of the second quarter earnings from Indian software company Infosys (INFY

), I noticed a few quirks regarding the stock’s dividend yield that I felt I needed to highlight. Infosys trades on the New York Stock Exchange as an American Depository Receipt, or ADR. Though technically not a stock, ADRs still trade like stocks. Ultimately, they give investors an easier chance to invest in foreign companies. However, ADRs can be confusing, especially when it comes to their dividend payouts and reported yields. As such, investors need to be aware of what they might be investing in prior to making any decisions.

), I noticed a few quirks regarding the stock’s dividend yield that I felt I needed to highlight. Infosys trades on the New York Stock Exchange as an American Depository Receipt, or ADR. Though technically not a stock, ADRs still trade like stocks. Ultimately, they give investors an easier chance to invest in foreign companies. However, ADRs can be confusing, especially when it comes to their dividend payouts and reported yields. As such, investors need to be aware of what they might be investing in prior to making any decisions.

Often, foreign companies like Infosys and other ADRs do not declare consistent quarterly dividend yields, unlike most U.S. companies. Because of this, it is hard for investors to get a true sense of how a company is constantly increasing its dividends and a picture of its annualized dividend yield. This confusion and inconsistency might not make these stocks the best investment for investors seeking stable income payouts.

Currency ComplicationsDividend declaration inconsistency is not the only problem with investing in ADRs, however. It may seem obvious, but foreign currency exchange ultimately plays a meaningful role with ADRs and their dividend yields as well. These foreign companies’ ADR dividends are typically declared in the operating currency for the company, but paid to the ADR holders in dollars. The exchange rate plays a big role in what U.S. investors ultimately receive in dividend payouts.

But for argument’s sake, let’s say that these foreign companies do pay out consistent dividends and the exchange rates do not make a meaningful impact. This does not mean investors will end up getting what the yield suggests; taxes end up playing a role. Many countries require companies that pay dividends to foreign shareholders to withhold taxes from the payout, thus reducing the total dividend paid to the shareholder. Though these taxes are deductible for individual tax purposes, it is still a factor that investors should be aware of prior to making investing decisions.

Saturday, October 12, 2013

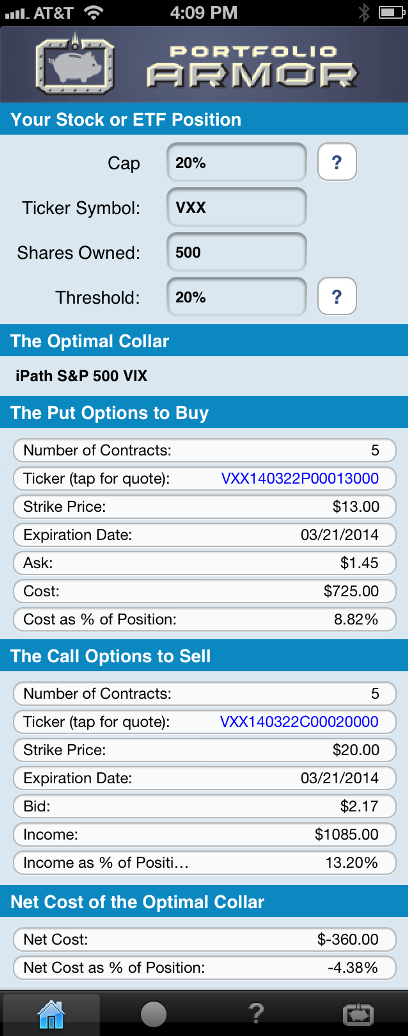

Getting Paid To Limit Your Downside On VXX

Getting Paid To Limit Downside On VXX

Since inception, the iPath S&P 500 VIX Short Term Futures ETN (NYSE: VXX) has declined nearly 99%, but it’s up about 10% so far this week as the government shutdown continues. For VXX longs savoring their gains since Monday, but wary of downside risk going forward, below is a way you can get paid to hedge.

Hedging With A Negative Cost Optimal Collar

Pays you to hedge, 20% upside cap.

If you’re willing to cap your potential upside at 20% over the next several months (although, realistically, who probably wouldn’t be in this position that long), this was the optimal collar, as of Wednesday’s close, to hedge 500 shares of VXX against a greater-than-20% drop over the same time frame.

As you can see at the bottom of the screen capture above, the net cost of this collar was negative, meaning you would have gotten paid to hedge in this case.

Note that, to be conservative, Portfolio Armor calculated the cost of this hedge by using the bid price of the call leg and the ask price of the put leg. In practice, you can often sell calls for more (at some price between the bid and ask) and buy puts for less (again, at some price between the bid and ask), so, in actuality, an investor opening the optimal collar above would likely have netted more than $360 to do so.

Possibly More Protection Than Promised

In some cases, hedges such as the ones above can provide more protection than promised. For a recent example of that, see this post about hedging shares of the SPDR Gold Trust ETF (NYSE: GLD).

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance PhD to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones.

**Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. The algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University. The screen captures above come from the Portfolio Armor iOS app.

The following article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

Posted-In: Options Markets Trading Ideas

Around the Web, We're Loving... Cyber Trading University Presents: The Psychology of a Winning Trader Rumsfeld: Denial of Benefits to Fallen Soldiers' Families 'Inexcusable' Facebook, Baidu Lead Big Caps Beating Shutdown What Should You Know About AMZN? Most Popular These Four Story Stocks Got Beat Up Tuesday (TSLA, LNKD, NFLX, FB) Hewlett Packard's Chromebook 11 Features Innovation Not Found In Apple's MacBook (GOOG, HPQ) UPDATE: J. C. Penney Company, Inc. Provides Update on Progress of Turnaround Yahoo Chose Apple's iPhone, MacBook Pro To Promote Mail Upgrade Apple's iPad 5 Event To Crash Surface Release Party On October 22 Apple Should Have 'Immediately' Apologized For iPhone Blunder Related Articles (GLD + VXX) Getting Paid To Limit Your Downside On VXX ETF Outlook for October 9, 2013 (GLD, XRT, BWX) Gold Futures Turn Negative ETF Outlook For October 8, 2013 (VXX, GREK, UGA) Preparing For A US Government Default ETF Outlook for the Week of October 7 View the discussion thread. Partner Network #marketfy-ae-block { display: none; border: 2px solid #0a3f75; overflow: hidden; width: 300px; height: 125px; text-align: center; background-color: #45719E; position: relative; z-index: 1; } #marketfy-ae-block a { display: block; width: 300px; height: 125px; position: relative; z-index: 2; color: #ffffff; text-decoration: none; } #marketfy-ae-block-countdown-text { color: #f9fc99; padding: 0px 0 0 0; font-size: 19px; font-weight: bold; line-height: 19px; } #marketfy-ae-block-countdown-text-start { font-size: 12px; } #marketfy-ae-block-countdown { padding: 5px 0 5px 0; font-size: 26px; } #marketfy-ae-block-signup { padding: 5px 47px; } #marketfy-ae-block-signup:hover { background-color: #457a1a; } #marketfy-ae-block #marketfy-ae-block-logo { display: block; padding: 3px 0 0 0; margin: 0; } #marketfy-ae-block-logo { text-indent: -9999px; } #marketfy-ae-block-free { display: block; position: absolute; top: 7px; right: -23px; width: 80px; height: 16px; line-height: 16px; text-align: center; opacity: 1; -webkit-transform: rotate(45deg); -moz-transform: rotate(45deg); -ms-transform: rotate(45deg); transform: rotate(45deg); font-size: 13px; font-weight: normal; color: #333333; background-color: yellow; z-index: 500; text-shadow: 1px 1px #999999; } #marketfy-ae-block-arrow { position: relative; width: 60px; height: 60px; z-index: 10; margin: -80px 0 13px -21px; } #marketfy-ae-block-arrow img { height: 60px; width: auto; } Marketfy's InternationalTraders & Investors Summit Register for this FREE Event!

Hosted by Marketfy

Hosted by Marketfy  ybotq.push(function() { googletag.cmd.push(function() { googletag.display('div-gpt-ad-1346271905130

ybotq.push(function() { googletag.cmd.push(function() { googletag.display('div-gpt-ad-1346271905130

Friday, October 11, 2013

Goldman Sachs Cuts Price Target, Estimates on Mattel (MAT)

Early on Monday, analysts at Goldman Sachs lowered their price target on toy manufacturer Mattel, Inc. (MAT

) to reflect reduced earnings estimates due to a downturn in U.S. trends.

) to reflect reduced earnings estimates due to a downturn in U.S. trends.

The analysts maintain a “Neutral” rating on MAT, but now see shares reaching $38, down from the previous target of $39. This new price target suggests an 11% downside to the stock’s Friday closing price of $42.55.

Top 5 Medical Stocks To Own For 2014

A Goldman Sachs analyst noted, "We lower our 2013-15 EPS estimates to $2.52/$2.63/$2.83 ($2.54/$2.70/$2.90) to reflect a downturn in recent US trends, offset in part by the weaker USD. This suggests no EPS growth in 2013 after a strong run 2010-12. We lower our P/E and DCF-based 12 month price target by $1 to $38 to reflect our lower estimates. Our Neutral rating is unchanged."

Mattel shares were down $1.06, or 2.49%, during morning trading on Monday. The stock is up 13.03% year-to-date.

Thursday, October 10, 2013

Hub Group Drops 5% as Earnings Miss, Macquarie Cuts

Shares of Hub Group (HBGL) have plunged today after logistics company failed to deliver solid earnings.

Bloomberg News

Bloomberg News The Associated Press has the details:

The company said it expects earnings in the quarter that ended on Sept. 30 to be between 48 cents and 51 cents per share, below the 54 cents expected by analysts polled by FactSet. Full results will be released on Oct. 17.

It also predicted earnings for the year between $1.85 and $1.95 per share, also below the $2.02 expected.

JPMorgan’s Michael Weinz and Thomas Wadewitz explain what caused the miss:

Our sense is that the truck brokerage and intermodal segments experienced unfavorable mix impacts that would be a headwind to gross yields. Intermodal was negatively impacted by soft demand for West Coast originated shipments, which we believe generates more operating margin dollars per shipment due to a longer length of haul compared to local east traffic. Truck brokerage mix was negatively impacted by a decline in demand for high-value services, which would imply lower truck brokerage margins.

Macquarie’s Kelly Dougherty and team say Hub no longer deserves “the benefit of the doubt.” They write:

…we no longer think HUBG can deliver on the growth or margin improvement we previously expected given both intermodal (IM) & truck brokerage weakness. A seeming inability to pass through IM rail cost increases, coupled with ongoing truck brokerage challenges, leave us with little to get excited about even as we look beyond 2013.

They downgrade Hub to Neutral from Outperform with a price target of $37.50, down from $41.

Shares of Hub have dropped 5.1% to $35.41, but the plunge doesn’t seem to be weighing on other logistic companies. CH Robinson Worldwide (CHRW), for instance, has gained 1.1% to $58.64, JB Hunt Transport Services (JBHT) has risen 1.1% to $71.61, Swift Transportation (SWFT) has advanced 0.9% to $19.56 and Ryder System (R) is up 3.1% to $59.23.

Wednesday, October 9, 2013

Best Companies To Invest In 2014

Now that’s more like it. After yesterday’s aborted attempt at a big rally, U.S. stocks not only traded higher, but finished near the highs of the day, as well.

Getty ImagesThe S&P 500 gained 0.8% to 1,653.08, the Dow Jones Industrials rose 0.7% to 14,930.87 and the Nasdaq Composite advanced 1% to 3,649.04. Oil fell 1.2%, while gold dropped 1.6%.

The stock gains today were driven by events that in past weeks would have resulted in selling. President Barack Obama is closer to getting approval for an attack on Syria. Economic data suggests that tapering will begin this month. Really, it’s the same look.

Some suggest that markets have priced in a potential war and accounted for the impact of tapering. But just as notable is the improvement in China and other emerging markets. In fact, emerging markets are becoming “less of a drag,” say Ned Davis Research’s Alejandra Grindal and Joseph Kalish. They write:

Best Companies To Invest In 2014: Boart Longyear Ltd (BLY.AX)

Boart Longyear Limited provides drilling services, drilling equipment, and performance tooling for mining and drilling companies worldwide. The company operates through two divisions, Global Drilling Services and Global Products. The Drilling Services division provides a range of drilling services, including surface and underground coring, multi-purpose, reverse circulation, conventional air/mud rotary, flooded reverse, directional, sonic, and percussive production drilling to mining companies, energy companies, water utilities, environmental and geotechnical engineering firms, government agencies, and other mining services companies. This division provides drilling services for the exploration, development, and production of copper, gold, iron ore, nickel, and other metals and minerals. It conducts drilling services in approximately 40 countries in North America, South America, Asia, the Pacific Rim, Europe, and Africa. The Global Products division designs, manufactures, and sells drilling equipments and tooling. This division offers drilling equipment, drill rods, diamond bits, wireline core extraction systems, reverse circulation pipe and accessories, overburden tooling, pneumatic rock drills, rock drilling rods, and bits for various industries, such as mineral exploration, mining, energy, environmental sampling, and remediation, as well as infrastructure reinforcement and development. It provides mining products in approximately 100 countries. Boart Longyear Limited is headquartered in South Jordan, Utah.

Best Companies To Invest In 2014: Kearny Financial(KRNY)

Kearny Financial Corp. operates as a holding company for Kearny Federal Savings Bank that provides various financial services in New Jersey. The company offers various deposit products, including general deposits, interest-bearing and non-interest bearing checking accounts, money market deposit accounts, savings accounts, and certificates of deposits. It also provides various loans comprising one-to-four family mortgage loans; multi-family and nonresidential real estate mortgage loans; commercial business loans; home equity loans; home equity lines of credit; loans secured by savings accounts and certificates of deposit on deposit with the bank; construction loans to builders/developers and individual homeowners; and overdraft lines of credit, as well as offers vehicle loans and personal loans. In addition, the company sells insurance products, such as annuities to bank customers and the general public through a third party networking arrangement. As of June 30, 2011, it o perated 40 branch offices in Bergen, Essex, Hudson, Middlesex, Morris, Ocean, Passaic, Union, and Monmouth Counties of New Jersey. The company was founded in 1884 and is headquartered in Fairfield, New Jersey. Kearny Financial Corp. is a subsidiary of Kearny MHC.

Top 10 Tech Companies To Invest In Right Now: Tractor Supply Company(TSCO)

Tractor Supply Company operates retail farm and ranch stores in the United States. Its stores offer a selection of merchandise, including equine, pet, and animal products, such as items required for their health, care, growth, and containment; hardware, truck, towing, and tool products; seasonal products, including lawn and garden items, power equipment, gifts, and toys; maintenance products for agricultural and rural use; and work/recreational clothing and footwear. The company operates its retail stores under the Tractor Supply Company and Del?s Farm Supply names, as well as a Website under the TractorSupply.com name. As of December 31, 2011, it operated 1,085 retail farm and ranch stores in 44 states. The company serves recreational farmers and ranchers, as well as tradesmen and small businesses. Tractor Supply Company was founded in 1938 and is headquartered in Brentwood, Tennessee.

Advisors' Opinion:- [By Holly LaFon]

Company % of Assets Pepsico (PEP) 3.4 Philip Morris (PM) 2.3 Tesco PLC ADR (TSCO) 2.1 Molson Coors Brewing (TAP) 2.1 Microsoft (MSFT) 1.9 Merck (MRK) 1.9 Procter & Gamble (PG) 1.8 Avon Products (AVN) 1.6 Wal��art (WMT) 1.6 Medtronic 1.6 Hospira (HSP) 1.5 BP (BP) 1.4 Medco Health Solutions (MHS) 1.3 Johnson & Johnson (JNJ) 1.3 Unilever NV (UL) 1.3

Jeff is also optimistic about natural gas and believes the recession in Europe could be setting up "a generational buying opportunity." - [By Namitha Jagadeesh]

Tesco Plc (TSCO) dropped 3.5 percent to 360.9 pence. JPMorgan Chase & Co. cut its rating on the shares to underweight from neutral, meaning that investors should hold less of the shares than are represented in benchmark indexes. The brokerage cited weak same-store sales and said that initiatives such as ��ouble Clubcard Points��in 2010 and the ��rice Promise��in 2013 have had limited success.

- [By Jonathan Morgan]

Jeronimo Martins SGPS SA lost 1.9 percent to 14.31 euros after Tesco Plc (TSCO) reported that same-store sales in Poland dropped 6.4 percent in the first half of its financial year. The Portuguese retailer generated 60 percent of its revenue from the east European country in 2012.

- [By Trista Kelley]

Provexis halved its underlying operating loss for the year ending in March to 1.1 million pounds, helped by an 11 percent sales gain in Science in Sport products to 5.5 million pounds. The products include versions with caffeine, nitrates to increase stamina or choline to help the body derive energy from fat, the company said. SiS gels are sold online, at cycling shops and in grocery chains including Tesco Plc. (TSCO)

Best Companies To Invest In 2014: Primeline Energy Holdings Inc. (PEH.V)

Primeline Energy Holdings Inc. operates as an independent oil and gas exploration and production company in the People�s Republic of China. It holds rights in the LS36-1 gas field in the Block 25/34 under a petroleum contract in the East China Sea with a total contract area of 85 square kilometers; and the Block 33/07 under a petroleum contract with a total contract area of 5,877 square kilometers of offshore area surrounding the Block 25/34. The company was founded in 1993 and is headquartered in Hong Kong, Hong Kong.

Best Companies To Invest In 2014: ASF Group Ltd(AFA.AX)

ASF Group Limited, an investment company, operates in the resources, property, travel, commodities, infrastructure, and financial services sectors in Australia and China. The company holds interests in various mineral exploration projects, including the South Ellendale thermal coal and diamonds project covering an area of approximately 2,000 square kilometers in the Canning Basin of Western Australia; and two mineral exploration ventures for base metals and gold in Tasmania. It also involves in the shipping of bulk commodities from Australia to markets in China; development of port and rail facilities; and provision of property services to Chinese investors in Australia, as well as provides funds management and advisory services. ASF Group Limited was founded in 1980 and is headquartered in Sydney, Australia.

Best Companies To Invest In 2014: Guanwei Recycling Corp.(GPRC)

Guanwei Recycling Corp. engages in the manufacture and distribution of low density polyethylene (LDPE). It produces LDPE from plastic waste procured in Europe, which it recycles into recyclable LDPE for sales to approximately 200 manufacturers in China. The company also sells scrap materials, including plastic. It primarily serves building and construction industry, where there is an ongoing governmental push to promote the use of plastic in various products, such as water and sewage pipelines. The company sells its products to customers in a range of industries, including shoe manufacturing, architecture and engineering products, industrial equipment and supplies, and chemical and petrochemical manufacturing. Guanwei Recycling Corp. was founded in 2005 and is based in Fuqing City, the People?s Republic of China.

Best Companies To Invest In 2014: Fairfax Financial Holdings Ltd (FRFHF.PK)

Fairfax Financial Holdings Limited (Fairfax) is a financial services holding company. The Company, through its subsidiaries, is principally engaged in property and casualty insurance and reinsurance and the associated investment management. The Company�� segments consist of Insurance, Reinsurance, Insurance and Reinsurance Other, Runoff, and Corporate and Other. On December 22, 2011, the Company completed the acquisition of 75% interests in Sporting Life Inc. On August 16, 2011, the Company acquired William Ashley China Corporation. On March 24, 2011, an indirect wholly owned subsidiary of Fairfax completed the acquisition of The Pacific Insurance Berhad. On February 9, 2011, an indirect wholly owned subsidiary of Fairfax completed the acquisition of First Mercury Financial Corporation. In October 2012, its RiverStone runoff subsidiary acquired all the outstanding shares of Brit Insurance Limited.

Advisors' Opinion:- [By Infinity Group]

With 515 million shares outstanding, this equates to 33% of all shares being shorted. It should also be noted that Prem Watsa's Fairfax Financial Holdings (FRFHF.PK) is holding 51.8 million BlackBerry shares. Prem Watsa stated at the annual FairFax shareholders meeting that Fairfax is holding a long position with BlackBerry and anticipates shareholder value increasing over the next 2-3 years. The cost basis for FairFax financial holdings is approximately $17 per BlackBerry share.

- [By Alex Jordon]

There's talk that Prem Watsa, head of Fairfax Financial Holdings (FRFHF.PK), could possibly be involved in a privatization bid for the company. Consider:

Best Companies To Invest In 2014: Pound/Rand(PX)

Praxair, Inc. engages in the production, distribution, and sale atmospheric and process gases, as well as surface coatings in North America, Europe, South America, and Asia. The company offers atmospheric gases, such as oxygen, nitrogen, argon, and rare gases; and process gases comprising carbon dioxide, helium, hydrogen, electronic gases, specialty gases, and acetylene. It also designs, engineers, and builds equipment that produces industrial gases; and manufactures precious metal and ceramic sputtering targets used primarily in the production of semiconductors. In addition, the company supplies surface coatings consisting of wear-resistant and high-temperature corrosion-resistant metallic and ceramic coatings and powders to the aircraft, energy, printing, textile, plastics, primary metals, petrochemical, and other industries. Further, it provides electric arc, plasma, and oxygen fuel spray equipment, as well as arc and flame wire equipment used for the application of wea r-resistant coatings; and distributes welding equipment purchased from independent manufacturers. The company sells its products primarily through independent distributors. It serves various industries, such as healthcare, petroleum refining, computer-chip manufacturing, beverage carbonation, fiber-optics, steel making, aerospace, chemicals, and water treatment industries. The company was founded in 1907 and is headquartered in Danbury, Connecticut.

Advisors' Opinion:- [By Rich Duprey]

Industrial gas maker Praxair (NYSE: PX ) announced today it is expanding its presence in southern Russia with the acquisition of Volgograd Oxygen Factory, an�industrial gas producer with�some 2,000 customers across the�steel, aerospace, health care, and food and beverage industries, which it says will offer "immediate synergies" with Praxair's newly built�air separation plant in�Volgograd.

Tuesday, October 8, 2013

U.S. Stocks Break Losing Streak

U.S. stocks held onto earlier gains through the closing bell and snapped a string of recent losses as positive job market data helped offset worries about a budget standoff in Washington.

The Dow Jones Industrial Average climbed 0.4% to 15,3218.2. The Standard & Poor's 500 index rose 0.35% to 1,698.7, breaking its longest losing streak this year.

And the Nasdaq Composite gained 0.7% to 3,787.4.

Uncertainty over the Fed’s policy intentions and rising worries about the budget and debt-ceiling talks have some investors climbing a wall of worry. Lawmakers are fighting over a short-term spending bill to keep the government running when the next fiscal year starts Oct. 1. But Democrats have been unwilling to give into GOP demands, namely the defunding of President Barack Obama's health care reform law.

It was a busy day on the economic data front. The number of Americans seeking new unemployment benefits remained near six-year lows in the latest week. The number of initial jobless claims fell by 5,000 to a seasonally adjusted 305,000.

Economic growth during the second-quarter was left unrevised at 2.5%.

And sales of previously-owned homes fell in August for the third month in a row, as an index for pending sales of existing homes declined 1.6%, slightly more than expected.

The yield on the 10-year Treasury note ticked up to 2.648%. Bond yields move inversely to bond prices.

November crude-oil futures edged higher, while September gold futures slipped a bit. And the U.S. dollar gained ground against both the yen and the euro.

In corporate news, J.C. Penney (JCP) rose almost 3% to close at $10.42. The company issued a news release Thursday saying that it anticipates positive same-store sales for the rest of the year, and CNBC reported that the company’s CEO doesn’t see conditions this year where the company would raise liquidity.

Bed Bath & Beyond (BBBY) rose 4.5% to $77.54 after the retailer reported late Wednesday fiscal second-quarter earnings and revenue that topped estimates, and provided an upbeat earnings outlook.

Meanwhile, Hertz (HTZ) plunged 16% to close at $21.63 after it lowered full-year 2013 financial forecasts.

Sunday, October 6, 2013

Holding 30 stocks over 78 years ago creates win…

A winning fund, apparently.

ING Corporate Leaders Trust (ticker: LEXCX) was formed in 1935, when Franklin Roosevelt was president and the nation was still in the Great Depression. Management took the stocks of 30 leading companies and bought an equal number of shares in each.

That's it. The fund, formed as an unmanaged unit investment trust, only added stocks of spin-offs of the original 30 in the fund. Its turnover rate this year is zero.

Nevertheless, the 22 stocks in the fund (three have gone bankrupt, others have been merged) have gained an average 10.6% a year the past decade, according to Morningstar, which tracks the funds. That's an average of 2.7% a year better than the Standard & Poor's 500-stock index. The fund has beaten 89% of its peers the past 15 years and held up well in bull and bear markets.

The fund was designed to liquidate in 2015, but the fund's liquidation is now set at 2100. The fund's founders picked prosaic companies with strong brands and balance sheets, such as General Electric, Allied Chemical & Dye, E.I. du Pont de Nemours (DuPont) and Union Pacific Railroad.

According to Morningstar, no financial services companies were among those picked, reflecting the deep suspicion of the durability of banks in an era of bank failures. Nevertheless, Berkshire Hathaway became part of the portfolio when it bought Burlington Northern, a descendant of Santa Fe.

Similarly, Foot Locker is in the portfolio, because it descended from F.G. Woolworth.

The fund has no high-tech, high-performance stocks whatsoever in its portfolio, nor is it likely to. And that may be a good thing, says Kevin McDevitt, analyst at Morningstar. "The least-sexy companies are often the best investments over time," he says. After all, stocks with high expectations tend to get clobbered when they don't deliver.

In the 2007-09 bear market, the fund lost 44.1%, according to Lipper ! — which sounds bad until you realize that the S&P 500 lost 54% the same period. Since the March 2009 bottom, ING Corporate Leaders has gained 154%, putting it in the top 25% of all large-company value funds for the bear-to-bull round trip.

Because the fund has the same amount of shares in each holding, it rewards those whose share price has risen. (The fund holds Berkshire B shares, which closed Friday at $113.75; Berkshire A shares cost $170,743 apiece.)

After 78 years, it's hard to call the fund's performance a fluke. From 1959 through the end of September — the furthest back the Lipper database goes — the fund has gained an average 10.2% a year, vs. 9.8% for the S&P 500 with dividends reinvested. The fund ranks 15th among 72 funds with records stretching back that far.

Saturday, October 5, 2013

Benzinga's Most Read Stories for September 23, 2013

Want all of the good stuff in one place?

Well, the wait is over.

Now you can see Benzinga's top stories right here, on a silver platter.

Check us out on YouTube as well!

Click the links below to view Benzinga's most popular stories for today:

Google Investigating Gmail Delivery Issues And Attachment Fails By: Louis Bedigian Four Monday Must-Read Apple Stories By: Tim Parker Earnings Expectations For The Week Of September 23: BlackBerry, Nike And More By: Nelson Hem That Was Fast: Apple's Touch ID Already Hacked By: Jim Probasco Blackberry Is Following the Path of Another Now-Extinct Device Maker By: Tim ParkerBest Tech Stocks To Buy For 2014

Note: Stories may have been posted on previous days

Thursday, October 3, 2013

New Intel Chips To Challenge ARM Devices

NEW YORK (TheStreet) -- Intel's (INTC) next-generation Atom processors are about to make a big splash in new PCs , tablets and Chromebooks.

The new quad-core 'Haswell' chips are the latest addition to Intel's Atom line of lower cost processors. They are meant to compete head-on with the currently favored ARM (ARMH)-based chips. The new devices promise lower power consumption (and longer lasting battery reserves) and improved computing performance. All of which are perfect for the next series of portables to be released just in time for the holiday shopping season.

Intel shares were retreating 0.32% to $22.74 in early afternoon trading.

Until now, nearly all Chromebooks (lightweight, cloud-based computers that run everything through a Google (GOOG) Chrome browser) used ARM-based processors. The sole exception being the super-popular $250 Samsung Chromebook.